BUSINESS ONLINE and MOBILE BANKING

QUICK HELP USER GUIDE and FAQs

[Last updated 07/27/2023]

QUICK HELP USER GUIDE

|

|

|

(Click image to open)

|

(Click image to open)

|

FAQs

What are the ACH and Wire Cutoff Times with the new system?

- ACH Cutoff - 4:30 p.m. Eastern Time.

- Wire Cutoff - No changes. Cutoff times remain the same for Wires.

Where do I download the BCT Mobile App?

Download the BCT Mobile App from the Apple Store or Google Play Store.

Examples of business services on our BCT Mobile App:

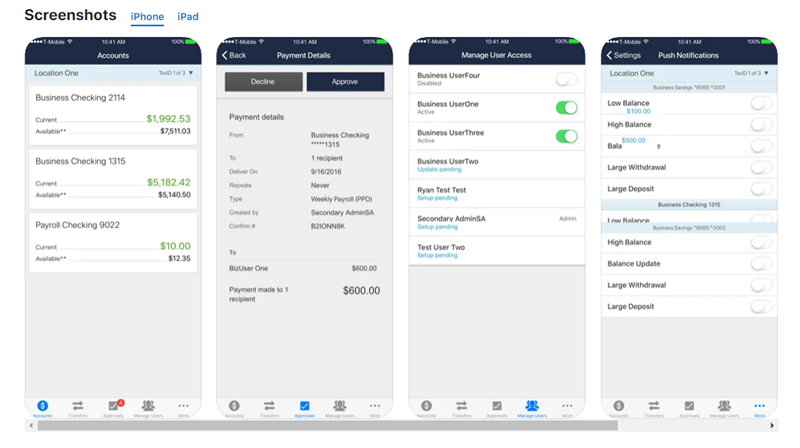

BCT Mobile App - Apple Devices

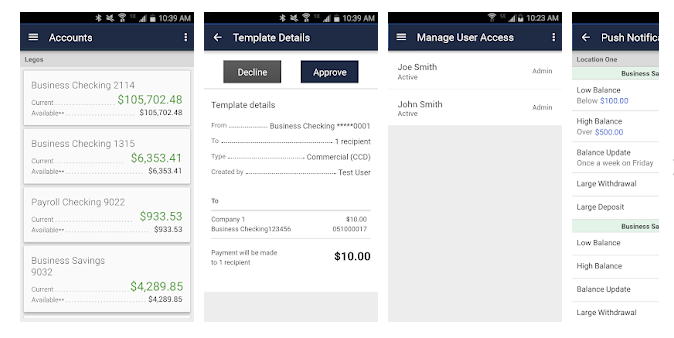

BCT Mobile App - Android Devices

Will I be able to deposit checks using the Mobile App?

Yes. The process to make a mobile deposit of a check(s) using our BCT Mobile App is almost like taking a picture with your device. Simply select "Deposit Check" in the menu and follow the instructions. Your device must have a camera to make a mobile deposit. If you make several check deposits on a regular basis, our Remote Deposit Capture (RDC) service may be a better fit. For the RDC service, you will receive a check deposit machine for your office just like the ones our Tellers use. If interested, contact our Cash Management Support team at 304-728-2409 or by email at CMSupport@mybct.bank.

When will funds be available for mobile deposits?

Funds are available from mobile deposits using the BCT Mobile App the next business day after clearing our approval process. This is a change from the previous mobile deposit process.

How do I update my email address and other contact information in the Online Banking system?

See the QUICK HELP USER GUIDE and review the My Settings section of the guide. There are step-by-step instructions included in that section.

What are the benefits of the Business Online and Mobile Banking solution?

The Business Online and Mobile Banking solution includes several enhancements and helpful features, including:

- A seamless, personalized banking experience across all devices including an optional view of business and personal accounts

- Quicker access to key features, making it easier to find the information and tools you need

- Customizable reports for your business needs

- Mobile secure approvals for Wires and ACH, including payroll

- Control your company’s Debit Cards by individual or group: spending & geographic limits, turn cards On/Off, and more (this feature to be added after launch)

How will I LOGIN to the Business Online Banking system?

Our Cash Management Support team personally contacted Business Online Banking and Cash Management customers to explain the new system and LOGIN process. If you need further assistance, contact our Cash Management Support team directly at 304-728-2409 or by email at cmsupport@mybct.bank.

What about BillPay?

Good news. Our Online Banking system provides for a robust payment system to your company to pay bills on the fly or with recurring, scheduled payments.