Updated: March 30, 2022

CDC: Quarantine and Isolation Guidance

People with COVID-19 and close contacts should follow the recommendations outlined on the CDC website here: https://www.cdc.gov/coronavirus/2019-ncov/your-health/quarantine-isolation.html

These recommendations do not change based on COVID-19 community levels

Updated: May 13, 2021

CDC: Fully Vaccinated Individuals May Resume Normal Activities

The CDC announced today that fully vaccinated individuals may resume normal activities without masks or social distancing, indoors and outdoors.

Updated March 17, 2021

ECONOMIC IMPACT PAYMENTS (STIMULUS) BEGIN POSTING TODAY

As announced March 12, BCT will begin posting Economic Impact Payments (Stimulus) direct deposits from the IRS to qualified customer accounts today, March 17, 2021. Not all Stimulus payments will be received from the IRS immediately. Payments will continue to be deposited into customer accounts over many days until all qualified recipients receive their Stimulus payments.

As a reminder, the IRS will send Stimulus payments through direct deposit to taxpayers who have an account registered with the IRS for tax reimbursements. If you do not have an account registered with the IRS, they will send a check to your registered taxpayer address.

Visit the Get My Payment page of the IRS for the most current information about your payment.

Updated: March 12, 2021

ECONOMIC IMPACT PAYMENTS (STIMULUS) BEGIN POSTING ON MARCH 17, 2021

BCT received notification today, March 12, that Stimulus payments will begin posting to customer accounts on March 17, 2021. Stimulus payments will continue to be deposited into customer accounts over many days until all qualified recipients receive their Stimulus payments.

As a reminder, the IRS will send Stimulus payments through direct deposit to taxpayers who have an account registered with the IRS for tax reimbursements. If you do not have an account registered with the IRS, they will send a check to your registered taxpayer address.

Visit the Get My Payment page of the IRS for the most current information about your payment.

Updated: March 11, 2021

ECONOMIC IMPACT (STIMULUS) PAYMENTS

The new COVID-19 Stimulus Bill was signed into law by President Biden today. We do not have information about the new round of Stimulus payments nor when direct deposits will begin to be deposited into your account.

Visit the Get My Payment page of the IRS for the most current information about your payment.

We will update this Helpful Information page as new information is made available.

Updated: February 20, 2021

Effective Monday, February 22, 2021: Branches Return To Full Open - Appointments Recommended for Certain Transactions

Branches Return to Full Open

BCT strived to provide customers and employees safe, touch-free alternatives during these past several months of COVID-19 governmental restrictions. With COVID-19 numbers showing sustained improvement over the past several weeks resulting in reduced restrictions by our governments, we believe it is time to "get back to business as usual" as quickly as possible.

Therefore, effective Monday, February 22, 2021, all BCT branch lobbies will be fully open and available for customers. Face coverings and social distancing will remain a requirement for customers and employees until further notice.

Appointments Recommended for Certain Transactions

For your convenience and continued safety, it is recommended customers continue to make appointments for transactions that may take more time.

Examples of transactions needing more time for which appointments are recommended:

- New account openings

- Applying for loans

- Safe deposit box access

Make Appointment

As always, any questions may be directed to our Customer Care Center at 1-800-296-8431.

Updated: January 8, 2021

Stimulus Debit Card Distribution

Starting this week, the Treasury Department and the Internal Revenue Service are sending approximately 8 million second Economic Impact Payments (EIPs) by prepaid debit card.

These EIP Cards follow the millions of payments already made by direct deposit and the ongoing mailing of paper checks that are delivering the second round of Economic Impact Payments as rapidly as possible.

For those who don't receive a direct deposit, they should watch their mail for either a paper check or a prepaid debit card. To speed delivery of the payments to reach as many people as soon as possible the Treasury's Bureau of Fiscal Service is sending payments out by prepaid debit card.

IRS and Treasury urge eligible people who don't receive a direct deposit to watch their mail carefully during this period. The prepaid debit card, called the Economic Impact Payment card, is sponsored by the Bureau of the Fiscal Service and is issued by Treasury's financial agent, MetaBank®, N.A. The IRS does not determine who receives a prepaid debit card.

Taxpayers should note that the form of payment for the second mailed EIP may be different than the first mailed EIP. Some people who received a paper check last time might receive a prepaid debit card this time, and some people who received a prepaid debit card last time may receive a paper check.

More information about these cards is available at EIPcard.com.

EIP Cards are safe, convenient and secure. EIP Card recipients can make purchases online or in stores anywhere Visa® Debit Cards are accepted. They can get cash from domestic in-network ATMs, transfer funds to a personal bank account and obtain a replacement EIP Card if needed without incurring any fees. They can also check their card balance online, through a mobile app or by phone without incurring fees. The EIP Card provides consumer protections including certain protections against fraud, loss and other errors.

EIP Cards are being sent in a white envelope that prominently displays the U.S. Department of the Treasury seal. The EIP Card has the Visa name on the front of the Card and the issuing bank name, MetaBank®, N.A. on the back of the card. Each mailing will include instructions on how to securely activate and use the EIP Card.

EIP Cards are being issued to eligible recipients across all 50 states and the District of Columbia. Residents of the western part of the United States are generally more likely to receive an EIP Card.

The swift issuance of this second round of payments follows the successful delivery of more than $270 billion in CARES Act Economic Impact Payments earlier this year. To check the status of a payment, visit IRS.gov/getmypayment. For more information about Economic Impact Payments visit IRS.gov/eip.

ECONOMIC IMPACT (STIMULUS) PAYMENTS

IMPORTANT UPDATE - Direct deposit payments will not begin to arrive in accounts until January 4, 2021 due to the New Year's Day holiday and weekend, and may take several days for all direct deposit payments to be made. Visit the Get My Payment page of the IRS for the most current information about your payment.

Recently, The Congress and President passed into law a second round of Economic Impact (Stimulus) Payments. Here's the latest:

- In separate news releases, Treasury and the IRS said initial direct deposit payments are being processed and will continue into next week. **As noted in the above important update, initial payments will not begin to arrive in accounts until January 4, 2021. To receive direct deposit payments, individuals or joint filers must already be registered for direct deposit with the IRS. Paper checks will begin to be mailed today, Dec. 30.

- Eligible individuals will receive an Economic Impact Payment of up to $600 for individuals or $1200 for married couples and up to $600 for each qualifying child. Generally, if you have adjusted gross income for 2019 up to $75,000 for individuals and up to $150,000 for married couples filing joint returns and surviving spouses, you will receive the full amount of the second payment. For filers with income above those amounts, the payment amount is reduced.

- This second round of payments will be distributed automatically, with no action required for eligible individuals. If additional legislation is enacted to provide for an increased amount, Economic Impact Payments that have been issued will be topped up as quickly as possible.

- As with the first round of payments under the CARES Act, most recipients will receive these payments by direct deposit. For Social Security and other beneficiaries who received the first round of payments via Direct Express, they will receive this second payment the same way.

- Anyone who received the first round of payments earlier this year but doesn’t receive a payment via direct deposit will generally receive a check or, in some instances, a debit card. For those in this category, the payments will conclude in January. If additional legislation is enacted to provide for an additional amount, the Economic Impact Payments that have been issued will be topped up as quickly as possible.

- The IRS offers more information on its EIP webpage, with status updates on individual payments available at its Get My Payment page.

We will update this Helpful Information page as new information is made available.

|

IMPORTANT UPDATE FROM ALICE FRAZIER

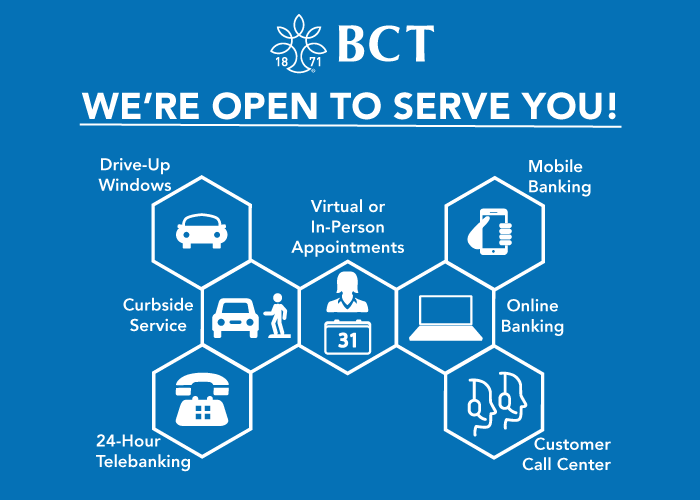

Open for Business: Drive-Thru, Curbside Service and Appointment-Only Branch Visits

Dear Valued BCT Customer,

Your BCT team is continually monitoring information and preventative measures taken by government and regulatory agencies regarding COVID-19 (coronavirus). For the safety of our customers and employees, we are returning to serving your banking needs only through our drive-thru, curbside and appointment-only branch visits.

Effective Wednesday, December 16, 2020, we will provide the following services to assist you:

- Branch Drive-Up Windows - Offered during normal business hours with expanded services to include debit card replacement, cashier’s checks, stop payments and more.

- Branch Curbside Service - Offered during normal business hours. Call your branch for service. A full listing of branch phone numbers is available on our website's Locations page.

- Virtual or In-Person Branch Appointments - Available during normal business hours. Masks are required for in-person visits. Appointments can be made by clicking Make Appointment. A full listing of branch hours is available on our Locations page.

We encourage you to try our new and enhanced Online and Mobile banking services. If you need help getting started, please call our customer care center at 1-800-296-8431.

- BCT Online Banking - 24/7 access to your accounts, with the ability to pay bills, transfer funds, and even pay people! To enroll, click "Enroll Now" on the large blue LOGIN box on our homepage.

- BCT Mobile App - The BCT Mobile App offers the same services as Online Banking but in a secure and easy-to-use app for your mobile device. The BCT Mobile App is available on The App Store and Google Play Store. Prior enrollment in Online Banking is required to use the Mobile App.

- BCT Mobile Check Deposit - Using our BCT Mobile App, deposit checks easily with your mobile device. It's like taking a picture and fully secure.

- BCT Customer Care Center – Our Care Center associates are available Monday through Friday between 8:30am-5:30pm, and Saturday 8:30am-Noon. Call 1-800-296-8431.

Thank you for choosing BCT for your banking needs and we appreciate your patience as we all navigate through these unusual times.

We will keep you advised of any changes to our services that will be impacted by COVID-19. Please continue monitoring our website and Social Media outlets (Facebook, LinkedIn, Twitter, Instagram) for updated information. You may also call your branch or the Customer Care Center. We’re here to help.

Sincerely,

Alice P. Frazier

President and CEO

Lobby Guidelines:

- Lobby capacity is limited due to social distancing requirements.

- Safer and faster service is available though Drive-Up Window service.

- Please observe Social Distancing rules.

- For the safety and consideration of our employees and customers, facial coverings are required.

- For security, all customers will be asked to lower face coverings briefly to be recorded by security cameras.

- No public restrooms are available.

Updated: January 15, 2021

SBA COVID-19 BUSINESS ASSISTANCE PROGRAMS *

SBA COVID-19 BUSINESS ASSISTANCE PROGRAMS *

We are participating in the second round Payroll Protection Program (PPP), a federal stimulus loan program to assist small to medium-sized businesses impacted by the COVID-19 pandemic. To Learn More about the program and to Apply, visit our information page about the Payroll Protection Program (PPP).

There are other SBA Disaster Loan Assistance programs that provide other assistance for businesses, including sole proprietorships, who have been financially harmed by the COVID-19 pandemic. Gather your financial records and business documents before starting the application process. To Apply and Learn More about the SBA Disaster Assistance Loan programs for businesses harmed by the impact of COVID-19, visit www.sba.gov.

Contact us about Business Assistance Programs at LoanHelp@mybct.bank.*

*BCT is approved to offer SBA loan products under SBA’s Preferred Lender Program.

REMINDER: Be Alert To Scammers and Fraudsters

Scam artists and fraudsters continue to use the COVID-19 pandemic (coronavirus) as a tactic to commit fraud. In our ongoing attempt to keep you safe, we wanted to bring your attention to a potential scam you might encounter. Fraudsters are reaching out to individuals and businesses claiming to be FDIC (Federal Deposit Insurance Company) employees, then trying to obtain personal and business information during the phone calls. The FDIC will rarely contact someone directly, so please don’t share your information. In addition, be cautious about clicking on email links or opening attachments referencing COVID-19, unless you are sure they are from a trusted source.

CONVENIENCE SERVICES

- Online Banking - Personal: Contact Customer Care team for help enrolling: 1-800-296-8431

- Cash Management - Business: Contact Cash Management team for help enrolling: 304-728-2409

- BCT Mobile App with Mobile Deposit - Download from The App Store or Google Play Store. Contact Customer Care team for help enrolling: 1-800-296-8431

- BCT BillPay

- e-Statements

- AllPoint® ATM network, 55,000 service-charge waived ATMs nationwide (no deposits) ATM Locations

- ATMs at Sheetz Convenience and Gas stores, service-charge waived (no deposits)

IMPORTANT CONTACT NUMBERS

PERSONAL HEALTH

Centers For Disease Control (CDC) COVID-19 Resources

NATIONAL RESPONSE AND INFORMATION

STATE RESPONSES (States with BCT operations)

Maryland

Virginia

West Virginia

* Email is not a secure form of communication. Do not include private information, including but not limited to bank account numbers, Social Security Number, birthdate, etc.