BCT Helps Possibilities Become Realities

Whether a large organization or one in its infancy, BCT's Business Banking team combines high-touch personal service with banking products and services to help you build a successful business. Founded in 1871, and we've been the financial partner for generations of businesses, helping guide them to growth and success.

Expert Knowledge with Unrivaled Personal Attention

With experience dating to 1871, we have developed a keen expertise and knowledge of solutions to help local businesses prosper. Whether financing equipment, facility expansion, or providing a line of credit to cover payroll or other expenses, we are here to support you. Moreover, with our experience we will work with you to tailor packages for your unique needs. And the best part... we remain a phone call away if you ever need our advice.

Business Banking Solutions

BCT offers banking solutions for businesses and organizations large or small. Your personal business banker will tailor solutions for your organization's needs and success for generations to come.

Solutions for Your Business

Financing - With years of experience and expertise, our business loan officers will work with you to tailor a loan package that will meet the capital needs of your business, from purchasing equipment, supplies, and real estate, to funding construction and renovations.1

Lines of Credit - Empower your business with the financial flexibility and security it deserves. Our experienced business bankers are committed to finding a line of credit solution tailored to your needs, whether it's for covering payroll, purchasing supplies, or addressing unexpected expenses.1

SBA Loans - The Small Business Administration (SBA) program is a federal government loan guarantee program to support small to medium sized businesses, both startup and mature. BCT is a SBA Preferred Lender which means we streamline the application and approval process. We offer loans under the SBA program 7(a), SBA Express, and 504.1

7(a) - The 7(a) program offers both term loans and lines of credit and is the most flexible in use of funds, such as long-term capital improvements, refinancing of business debt, purchases for inventory, equipment, and other operational needs.

SBA Express - SBA Express can be used for a variety of purposes just like the 7(a) program. In addition, the SBA Express program can be used for lines of credit.

504 - The 504 program is designed to finance the purchase of existing buildings and land, build new facilities and purchase long-term machinery and equipment. Down payments can be as low as 10% but can go up to 20% if the business is a startup or the property is considered “special-use.”

Checking account solutions - We offer three primary transaction accounts to help you run the day-to-day financial operations of your company. They are:

Business 250 Checking - Perfect for any business, church, community organization, non-profit, estates and escrows, and business trusts. Includes 250 free transactions per month and no monthly service charge.2 See Business Checking Solutions for details.

Unlimited Business Checking - Whether a large business, government or municipality, or other large organization, Unlimited Business Checking offers outstanding features with minimal cost to your organization.3 See Business Checking Solutions for details.

Business Analysis Checking - Designed for businesses with larger transaction volume high balances, and the need for Cash Management services. Provides an Earnings Credit Rate (ECR) that can offset eligible fees.4 See Business Checking Solutions for details.

Cash Management - Integrated into our business Online Banking system, our Cash Management service enables your business to access all of your accounts and incorporate several ancillary services like Remote Deposit Capture, Positive Pay fraud protection for checks and ACH transactions, Merchant Services, and more.5 See Cash Management for details.

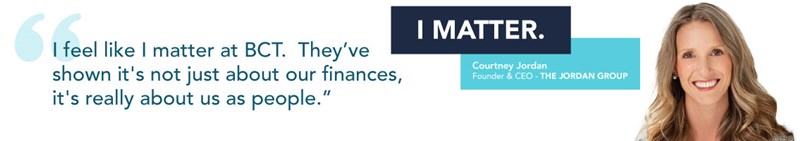

Award-Winner Client Service

The best part of BCT's business banking service is our award-winning client service. Voted the Journal-News "Best of the Best" and the LoudounNow "Loudoun's Favorite" bank, loan services, financial planning, and mortgage company, BCT is proud to serve you, your business, and your family with exceptional service for today and generations to come.

Get Started Today!

Find a Business Banker

Visit a Branch

1 All loans are subject to approval.

2 For Business 250 Checking, no transaction fee for first 250 transactions that post and settle during monthly cycle, $0.25 per transaction thereafter.

3 For Unlimited Business Checking, $2,500 average daily balance required during monthly cycle. $10.00 monthly service charge if average daily balance falls below $2,500.

4For Business Analysis Checking, an Earnings Credit Rate (ECR) is applied monthly to the average ledger balance of eligible account(s) from the prior month. The earnings amount may offset or eliminate eligible fees. ECR is not an interest rate.

5 Online Banking and Mobile App require internet and/or data connection. Usage fees may apply. Contact your internet or mobile service provider for details.